- YourCryptoFriend

- Posts

- 🧠 Issue #24 – Corporate Giants Embrace Stablecoins as Payment Rails

🧠 Issue #24 – Corporate Giants Embrace Stablecoins as Payment Rails

Clear insights for strategy, ops, and finance leaders.

A sleek corporate boardroom with holographic blockchain symbols floating above a conference table, showing Walmart and Amazon logos connected by glowing digital payment networks

📈 This Week in Business Crypto

1. Walmart & Amazon Eye Corporate Stablecoins for Massive Cost Savings

Why it matters: The world's largest retailers are reportedly exploring their own USD-backed stablecoins, signaling a seismic shift in how corporate payments could work. With Amazon's 638billioninannualrevenueandWalmart′s638 billion in annual revenue and Walmart's 638billioninannualrevenueandWalmart′s100+ billion in e-commerce sales, their stablecoin adoption could divert billions from traditional banking partners.

Actionable takeaway: If you're in treasury or finance, start researching how stablecoin settlement works and what infrastructure your organization would need. The GENIUS Act's 68-30 Senate advancement suggests regulatory clarity is coming fast.

Split-screen showing traditional bank payment processing (slow, expensive) versus blockchain stablecoin rails (fast, cheap)

2. Fortune 500 Stablecoin Interest Triples in One Year

Why it matters: Nearly 30% of Fortune 500 executives now say their companies are planning to use or are interested in stablecoins, up from just 8% in 2024. Meanwhile, 60% of these companies are already working on blockchain initiatives, with an average of 9.7 projects per company.

Actionable takeaway: Ask your strategy team about blockchain initiatives at peer companies in your industry. With 81% of small-to-medium businesses also interested in stablecoins, this isn't just a Fortune 500 trend.

Corporate executives in a modern office looking at rising charts and blockchain graphics, with "3x Growth" prominently displayed

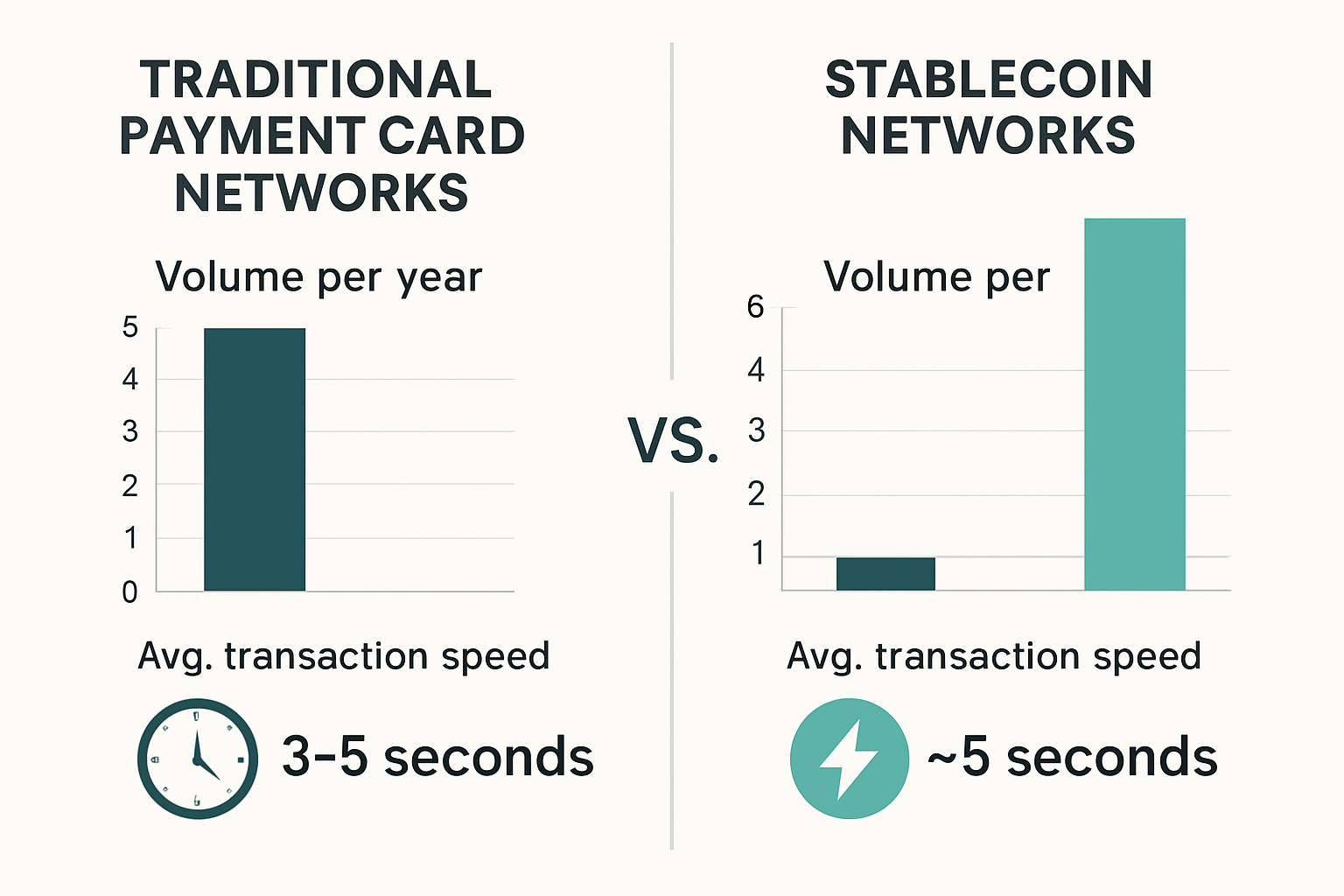

3. Stablecoin Volumes Now Rival Visa and Mastercard Combined

Why it matters: Stablecoin transaction volumes hit $27.6 trillion in 2024, surpassing the combined volumes of Visa and Mastercard by 7.7%. With 161 million stablecoin holders—more than the population of the world's 10 largest cities combined—this represents legitimate payment infrastructure, not speculative trading.

Actionable takeaway: Review your current payment processing costs and timelines. If your business handles significant cross-border transactions or high-volume payments, stablecoins could offer substantial savings on processing fees and settlement times.

Comparison infographic showing traditional payment card networks versus stablecoin networks, with volume metrics and speed comparisons

🏢 Industry Spotlight: Healthcare

Healthcare organizations are increasingly exploring blockchain for drug traceability and supply chain security. Here are three practical applications already being implemented:

Drug Authentication & Anti-Counterfeiting: Pharmaceutical companies are using blockchain-based systems with encrypted QR codes to track medications from raw materials to end consumers. This enables rapid identification and removal of counterfeit drugs, improving patient safety and regulatory compliance.

Supply Chain Transparency: Blockchain provides an immutable record of each step in the pharmaceutical supply chain, helping companies meet FDA requirements and respond quickly to contamination or recall situations.

Claims Processing Automation: Smart contracts on blockchain networks can automate insurance claims processing for medical procedures, reducing administrative costs and processing times from weeks to days.

What this means for your industry: If you're in healthcare, consider how blockchain could improve your supply chain visibility and regulatory compliance. For other industries, these use cases demonstrate blockchain's practical value beyond cryptocurrency speculation.

Modern pharmaceutical facility with blockchain network overlay showing drug packages being tracked through the supply chain

💼 Meeting Prep – Key Terms

Stablecoin Settlement: USD-like cryptocurrency used in B2B transfers, offering faster settlement times and lower fees than traditional banking rails.

GENIUS Act: Pending U.S. legislation (passed Senate 68-30) that would establish federal regulatory framework for stablecoins, potentially accelerating corporate adoption.

Tokenization: Converting real-world assets like real estate, commodities, or securities into digital tokens that can be traded on blockchain networks.

Smart Contracts: Self-executing blockchain-based agreements that automatically trigger actions when predetermined conditions are met, reducing need for intermediaries.

Corporate Stablecoins: Brand-specific digital currencies backed by traditional assets, allowing companies to create their own payment ecosystems while maintaining regulatory compliance.

🎯 Coming Next Week

•Shopify's USDC Integration: How e-commerce merchants will accept stablecoin payments by end of 2025

•CFO Risk Management: Top 3 strategies finance leaders use to manage crypto exposure

•Banking Response: How JPMorgan, Bank of America, and others are countering corporate stablecoin threats

YourCryptoFriend makes crypto trends simple, useful, and business-ready.

Reply